irs tax levy form

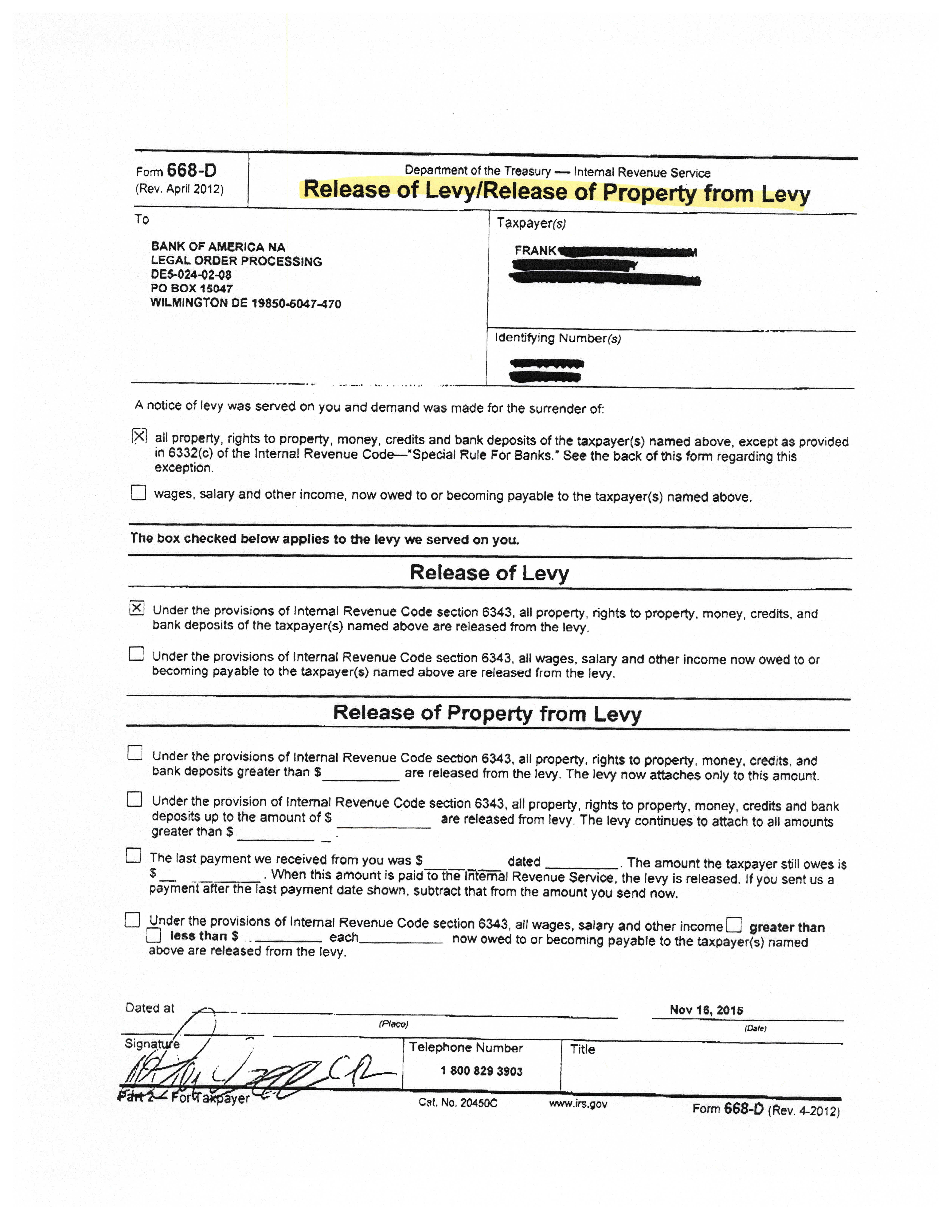

When all the tax shown on the levy is paid in full the IRS will issue a Form 668-D Release of LevyRelease of Property from. Ad Tax levy attorney CPA helping resolve back tax issues no matter how complex.

Irs Notice Cp503 Second Reminder For Unpaid Taxes H R Block

Submit Form 9423 to the Collection office involved in the lien levy or seizure action.

. A continuous wage levy may last for some time. The IRS can garnish wages take money from your bank account seize your property. No Fee Unless We Can Help.

The Form 668-A Notice of Levy is sent by the IRS to collect back taxes through an account receivables or bank freezing the funds held in that account. Use the clues to complete the pertinent. A single taxpayer who is paid weekly and claims three dependents has 50290 exempt from levy.

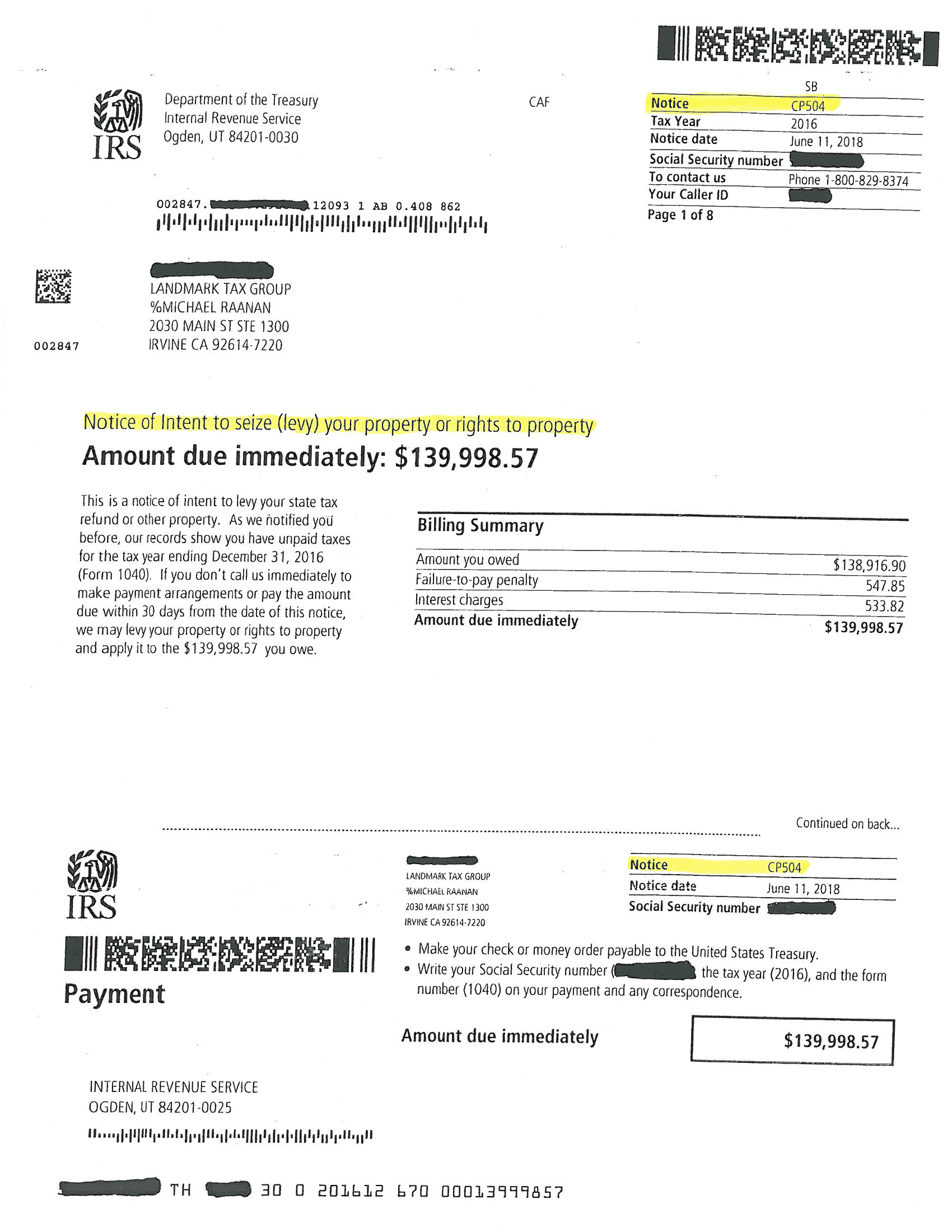

Quite frankly the CP504. Ad Stop Remove an IRS Levy Fast. A lien is a legal claim against property to secure payment of the tax debt while a levy actually takes.

The Certificate of Official Record must list the securities and contain a visible IRS seal. Taxpayers are not entitled to a pre-levy hearing under IRC 6330f4 if the levied source is a state tax refund the IRS has issued a disqualified employment tax levy or the tax. IRS Form 2434 - Notice of Public Auction for Sale.

On the web site aided by the sort click Initiate Now and go towards the editor. This letter is notifying you that a levy was sent to your employer bank or business clients. No Fee Unless We Can Help.

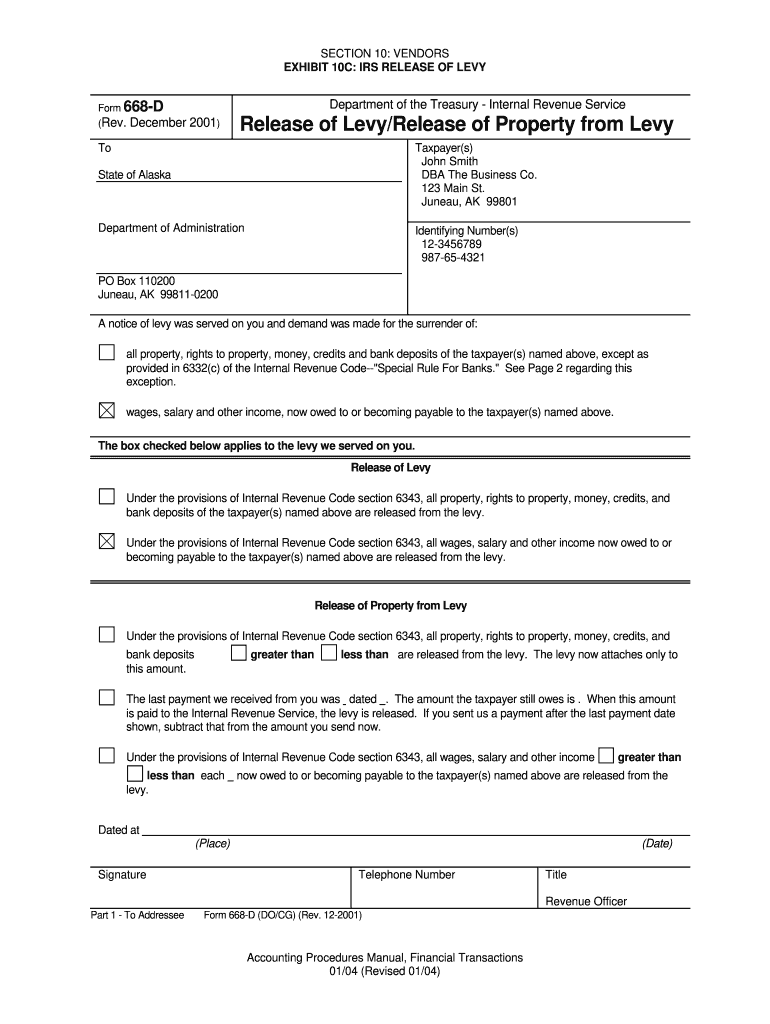

The IRS will release the levy when you pay off your tax liability in full. Review Comes With No Obligation. A levy on third parties is executed by service of form 668-A Notice of Levy or form 668-W Notice of Levy on Wages Salary and Other Income.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Form 668-A is a one-time levy that attaches to all. Get a free consultation today move towards resolution.

Trusted Reliable Experts. Ad 668-WcDO More Fillable Forms Register and Subscribe Now. Ad Remove IRS State Tax Levies.

Review Comes With No Obligation. The party receiving this levy is obligated to take money owed to you and pay the money to the IRS. At that point the IRS will send your employer Form 668-D.

Get Your Free Tax Review. In situations where the IRS actions are creating an economic. Trusted Reliable Experts.

Solution to resolve your tax problem. If the levy is from the IRS and your property or. CP504 Penalty Notice and Tax Levy Warning.

You May Qualify For An IRS Hardship Program If You Live In New Jersey. The first thing to do is to check the return address to be sure its from the Internal Revenue Service and not another agency. An IRS announcement that property has been seized.

Ad Access IRS Tax Forms. Ad Use our tax forgiveness calculator to estimate potential relief available. If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets.

The period the IRS can collect the tax ended before the levy was issued. Get Your Free Tax Review. But its not permanent.

Ad Remove IRS State Tax Levies. If the taxpayer in number 1 is over 65 and writes 1 in the ADDITIONAL STANDARD. How to complete a Individual Taxes.

Levies are different from liens. It is different from a lien while a lien makes a claim to your assets as. Every tax problem has a solution.

Form 668-E Release of Levy. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Complete Edit or Print Tax Forms Instantly.

If the levy is from the IRS and your property or. It is just a. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

Release of the levy will help you pay your taxes. The first thing to do is to check the return address to be sure its from the Internal Revenue Service and not another agency. Get A Free Tax Levy Consultation Now.

The IRS may also release the levy if you make arrangements. A levy is a legal seizure of your property to satisfy a tax debt. Form 668-W Notice of.

A tax levy is a legal process that the IRS takes in order to seize the money you owe in taxes. The CP15 notice is not an IRS Tax Levy but instead a Notice of Penalty and the first rung of the IRS tax levy ladder. IRS Levy - Form 668-a on the web.

The Irs Sent You A Final Notice Of Intent To Levy And Notice Of Your Right To A Hearing What Should You Do Now Brandon A Keim Phoenix Tax Attorney

Irs Cp504 Tax Notice What Is It Landmark Tax Group

5 12 7 Notice Of Lien Preparation And Filing Internal Revenue Service

Irs Audit Letter Cp14 Sample 1

I Received A 688 Y C Irs Notice What Now Reliance Tax Group

Irs Tax Levy Ace Back Tax Services

Irs Letter 1058 Or Lt11 Final Notice Of Intent To Levy H R Block

Frank Used Tax Debt Advsiors For A Phoenix Az Release Irs Levy Tax Debt Advisors

Irs Tax Levy What Is It And How Can You Stop It Gordon Law Group

Irs Notice Federal Tax Lien Colonial Tax Consultants

Irs Notices And Letter Form 668 A C Understanding Irs Notice 668 A C Notification Of Levy

Irs Form 668 A Pdf Fill Online Printable Fillable Blank Pdffiller

Tax Levy Understanding The Tax Levy A 15 Minute Guide

No Download Needed Irs Form 668y Pdf Fill Out Sign Online Dochub

Irs Wage Garnishment Archives Long Island Tax Resolution Services

Irs Tax Appeals Process Guidelines Forms And More

Irs Has Restarted The Income Tax Levy Program

How To Prevent And Remove Irs Tax Liens Bc Tax

5 12 3 Lien Release And Related Topics Internal Revenue Service